Steamboat has been dry, sunny, and full of Autumn color now for a weeks. It’s been wonderful to have Fall breezes and blue skies for a long time. Yes, we had some weather – like the windstorm that took out hundreds of trees on the mountainside and the few inches of snow we had. This weekend might be more snow, with the upper mountain areas seeing 10 inches or more. But you’re reading this for the data, so let’s get to it.

The market is slowing down right now, more so due to seasonal patterns more than anything else. This time of year we generally see a slowing through Winter and energy picks up again in Spring.

I have been monitoring the expected overall market activity in the nation. The third quarter was kick butt as our communities worked to recover from the Spring shutdowns as well as other changes in our lives and living. The fourth quarter isn’t expected to be much of anything, with growth being about 10% of what we just experienced.

What about real estate? Great question, and one I ask almost daily, and definitely whenever I come across another data point.

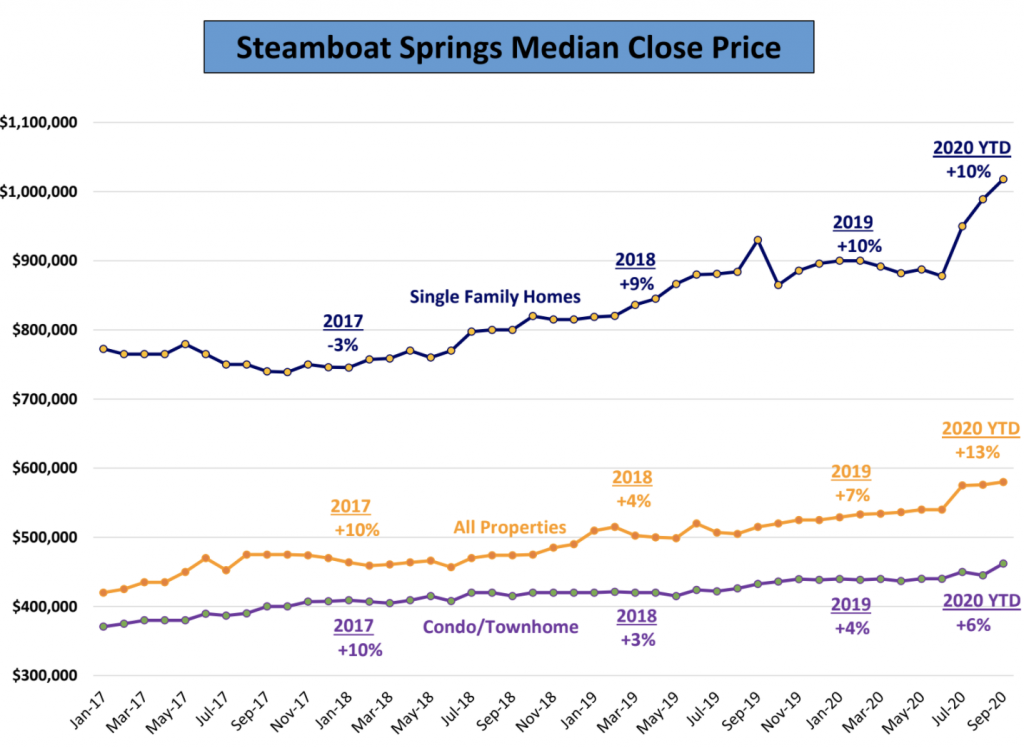

Value Increase: For the Summer, depending on the type of property being purchased, values in Steamboat rose 10-17%. Some of these purchases were persons moving here. Some of them were persons wanting a place to escape to. And some were buying because money was cheap and they could diversify money into a growing destination area.

Foreclosures: I’ve read many opinions on what real estate will do over the next while. One that I found interesting because I saw the same trend. Over the past several years, foreclosures have been few and competition for the opportunities strong. With the trend in renters not being able to pay landlords, and some homeowners who cannot recover from lost income, foreclosures are imminent. This is most likely going to look like a ‘regular’ or ‘normal’ rate rather than the trends we have just seen. For Steamboat, I don’t expect much of this. Owners here are commonly wealthy and smart. This will reduce our rate of foreclosed properties.

Still Moving Out: To me, any conversation of the City moving to the Country isn’t very valuable. I agree that downtown metro areas will continue to see an exodus. To equate that to Steamboat growth doesn’t make sense to me. Most of this movement is to the suburbs. Movement to destination areas like Steamboat or Summit County will continue, just at what rate is the money question.

National Slow Down: Yep, it’s going to happen. Right now, some pundits consider our pre-COVID pace will occur in Summer 2021. I think it is premature to make any kind of determination about that. Many factors ranging from the decisions of government leadership, growth of illness shutting down sections of the economy and states, supply chains maintaining health, and general mood of local and national communities are volatile to price into any projection beyond three months.

Market Pick Up: I’ve for a couple of weeks now have been thinking the stock markets have priced themselves for a Democratic sweep nationally. This will change many things from stimulus packages to handling of the virus. Even with the tech shakeup just beginning (and this shakeup has been coming now for at least three years), most industries will still produce steadily.

I’m most curious about how homebuilding stocks and supplies will fare. It appears that this industry is very positive. But still, I’d like to find the answer to ‘how many houses do we need before we have too many?’ There are replacement houses that need built. There are towns where jobs are booming and need housing. And there are destination areas that are seeing small growth from location neutral businesses. In Steamboat, there is a housing unit for every resident in this town. Yes, this is typical in a resort town, and is still a little fascinating.

Really Long Term: Steamboat Resort has plans to continue expanding. A new gondola to take persons to the top of Sunshine Lift, Pony area expansion, as well as making beginner skiing more accessible are indicators of the Steamboat Resort’s bullish outlook. For housing, developers who own lots in Steamboat Springs are not moving them quickly and are not in a hurry for anything. The City of Steamboat Springs’ leaders have difficulty negotiating with big developments. And expanding the city areas is slow going at best. These factors will continue to put upward pressure on the values of homes in the city limits.

Opportunity Now: Where would I put my money? Most segments of this market look like they will grow and the properties purchased/held performs per strong investment strategies. Of course, the commercial is soft when it comes to retail and hospitality type properties. These values will eventually grow once new renters with strength return. Where I think the best values are now are properties that outside of the city limits. It’s my perception that bedroom communities nearby are seeing a renaissance which is not being seen by many because so much attention is being given to Steamboat.

History Repeating: I’m a contrarian by nature, sometimes kicking my own butt for being more conservative than necessary. From many whom I’ve learned the most, they believed history to repeat itself. (Of course, I’m still waiting for the value of bonds in the 1980’s to come back!) What I have noticed is continuing conversation about war with China over the South China Sea (and most recently about invading Taiwan). And the lack of stimulus monies being distributed by the government. And comparing news headlines from 1918-1920 to those of today. Too many similarities from 100 years ago to today for me to increase my debt without good cause or use more discretionary income.

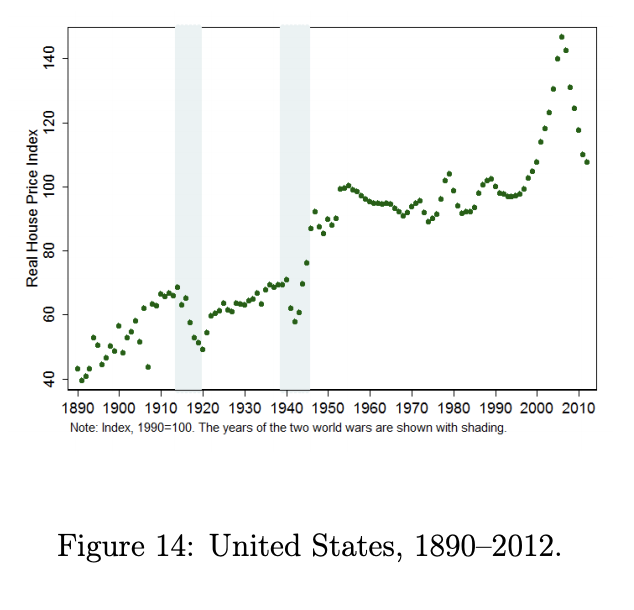

History Repeating for Real Estate: Though times were just as awkward this time in the last century, and the stock market was uncertain, even during the Great Depression values on homes increased. Here is a graph from the Federal Reserve Board of Dallas from a 2014 report titled No Price Like Home: Global House Prices from 1870 – 2012:

Success Is Inevitable: America rocks. Though we have our differences, we know how to survive and maintain being leaders internationally. I’m confident in America and our long term economic prospects.