Steamboat is seeing the end of the Summer approaching quickly. We have had a rush of visitors over the past few weekends, which makes me think school is about to start. We have a bunch of smoke from a large fire near Glenwood Springs, and some monsoon-like weather in the afternoons. Overall, it’s interesting weather during interesting times.

And interesting times it is! The real estate market in Steamboat is the strongest I’ve seen it and parallels 2006-2007. There are definitely more buyers than sellers right now. With the pandemic ongoing, those who have a place in Steamboat do not really want to move or let it go. There are reasons to hold property in this market, mostly valuation is going up and there isn’t a replacement property to purchase that would be a move-up home.

Some experiences I have had over the past month:

– a duplex side sold for about $500 a square foot when comps less than a year old indicate it is worth about $400 a square foot. The prior side of the duplex took a year to sell. This unit took about a week.

– I helped a baker find a kitchen to move in to. This was very difficult, even with restaurants struggling over the Summer. Three have opened in the past three months. And then a second customer wants something similar. Even with the bad news of hospitality businesses across the nation, Steamboat has folks who think business will grow.

– I listed a manufactured home on a rented lot. Within 5 days I had 4 offers.

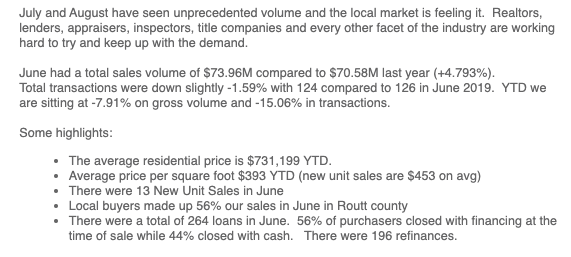

Real estate is very active now. Here’s a snapshot of the last month, from Melissa Gibson at Land Title here in Steamboat Springs:

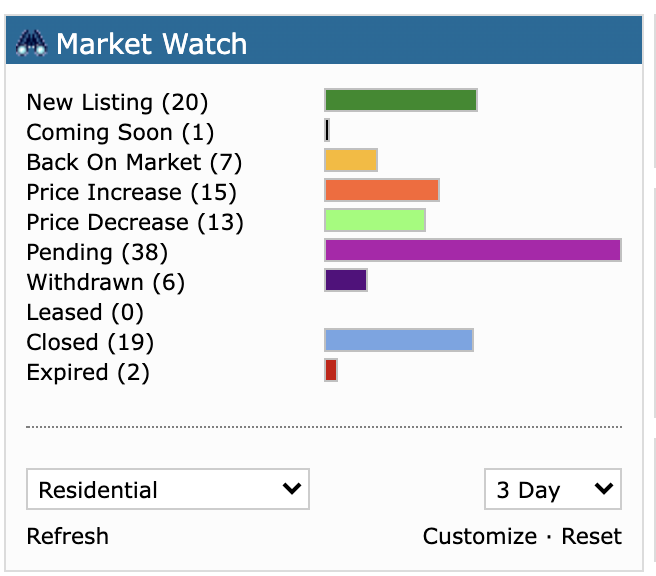

And here is a small screenshot of my MLS database. These numbers are a three day count have been consistent for more than a month:

When people ask me about what the market is doing, where it is going, and timing, I inhale deeply and ask more of what they are looking for. These three pieces each are a conundrum.

What is the market doing: Higher end properties are selling more often. Lower end properties (those $500,000 and under) do sell, but more slowly. This observation is reversed from what I saw over the Winter.

Where is the market going: With inventory running out, prices will trend upwards. It seems like persons are not concerned as much about overvaluation as they are about missing out. And missing out could mean anything from having a haven to move to from metro areas to not actualizing their Steamboat Springs retirement plan. With interest rates so low, it has opened up opportunity to buy.

Timing: This is very difficult to me. Timing changes easily from government stimulus to fearful headlines in newspapers, and the election is a non-starter. Real estate doesn’t commonly have quick market movements. Since March, when COVID caused Colorado to shut down, the market has swung uncharacteristically. Is this the top of the market? Should I wait to buy? I really don’t know. More government stimulus will likely keep trends we’ve seen over the past months continue. Trends the government, and some economists, are surprised by is the recent slow down in consumer spending and the increase in savings of households.

I have followed information on Colorado COVID forecasts. As Winter approaches, and we spend more time indoors, the growth of cases increases steadily through October and November. If other states see similar patterns, the actions the government takes will help us understand further what the market will do in the short term. For the long term, the results of mortgage and rent forbearance are my bet for what will be the most interesting real estate trends news.