I’ve been thinking about this post for two weeks, at least. Researching, listening to smart people, reading graphs, and scratching my chin. And in the meantime, I took a weekend with family and friends to enjoy some bluegrass mountainside.

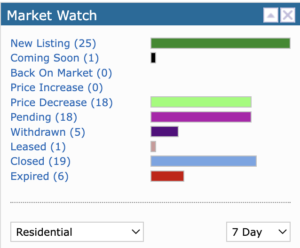

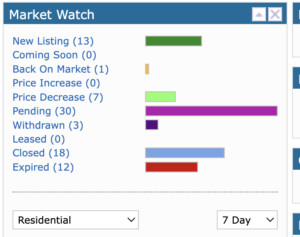

So, the best, solid information would be directly from the home page of my MLS service. Here’s some data to consider:

This data is from the week of 2/21 to 2/27.

And this data is from the week of 2/28-3/6.

These week-over-week screenshots say a lot. And the information hasn’t changed much all Winter. In today’s market, there are property listings that expire, which didn’t happen a year ago. There are price decreases. Listings going back on the market had been unheard of for two years or more. It’s tempting to think this market is trying to ‘normalize’, but I think it’s too soon to tell. Once the Spring market gets rolling, local trends will be easier to discern in relation to the greater national economy.

Inventory is very limited, yet, many properties stay on the market for up to a month before someone is willing to purchase. When I searched price drops, looking to find changes in Seller thinking, I found that many were making significant changes to their prices. Yes, one or two out of 25 might not have motivation, but most do.

As of this writing, 15 condominiums are for sale between $415,000 and $8,000,000, with 12 priced $850,000 or less.

I’ve read conversations where Denver home prices have fallen 5.8% this year. For Steamboat to see this change, it will take another 6 months or so. Being rural to Denver, it takes a little time to catch up with economic trends. Looking at the price changes in the above screenshot, it seems that sellers are getting more motivated.

These times are odd for sure. No one seems to understand what is going on with long-term economic trends. I’m beside myself as well. It seems like we are going to enjoy a recession, however, jobs are everywhere, wages are trending up, and more. In real estate, those who need to move are about the only persons buying and selling right now. And from viewing the trends above, interest rates for mortgages aren’t hampering many in the Steamboat market.

A fascinating read I found was on Steve Eisman (The Big Short) commenting on current market trends. He said:

“Markets have long periods of paradigms where certain groups are leaders,” the hedge funder told Bloomberg in an episode of the Odd Lots podcast Monday. “Sometimes those paradigms change violently, and sometimes those paradigms change over time, because people don’t give up their paradigms easily. And I think we’re going through a period, possibly, like that again.” Eisman pointed to Thomas Kuhn’s 1962 book, The Structure of Scientific Revolutions, as evidence that markets may be undergoing a gradual, yet volatile paradigm shift.

“When Einstein created his theory of relativity, for example…It’s not like everybody said, ‘Oh, we’ve been waiting for Einstein, thank God, now we can get rid of Newton.’ It took several years for people to realize that that was a better theory. I think something like that happens in markets,” he said. “Paradigms are so deeply ingrained in people’s brains they can’t even imagine, at times, that there could be anything else.”

I watch for these thoughts in my own analyses, and I’m constantly caught in my own paradigms. It’s going to be interesting what happens over time. Eisman’s words are likely very correct.