Steamboat Springs is having a great Summer, both in weather and economically. Tourists and second home owners are enjoying all that the town brings. Events from bike races to Farmers Market are well-attended and full of people with smiles!

Over the past several months, I have been watching local and national markets with interest. Now we have finally started the upwards trend in interest rates.

The market in Steamboat Springs is very stable, in my opinion. There are many transactions that are solid in today’s values. The local market has a number of properties changing hands, just not like they were over the last few years. Many properties are also falling out of contract. And the biggest symptom of the market has hit its top, numerous owners are lowering their asking prices.

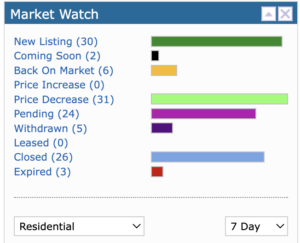

Here is what the past week looks like:

Owners lowering their prices is significant. Most of these value changes are on property over $500,000. In the several downturns I have experienced, this is common. The higher end of the market sees stagnation first. These owners may not see their asking price again for a number of years. In fact, before the pandemic, you could buy a luxury home cheaper than you could build one. And some owners were able to cash out from the 2008 frenzy because values finally got even with their original purchase price.

The Fed is definitely late and raising rates like a parent trying to keep the candy from a child. The opinions I’ve read from smart people have varied and I find them not very trustworthy in the short term. The Fed is going to continue their rate increases for a few more months, at which point they will have gone too far and in Summer 2023 we will begin to deal with issues we haven’t seen in over 40 years. These can be from stagflation to something worse than the Great Recession.

One pundit I enjoy studying is Jeremy Grantham. He’s an economist badass. His comments, as well as Ray Dalio, relate to the upcoming times being similar to the Great Depression. As you know, I believe in history repeating itself. When the pandemic started, I studied market trends from 1915 to today. What I found is that the trends we are seeing economically are similar to those then. I wouldn’t be surprised to see the smart guys be right on the money.

One of the most interesting trends I noticed, is that real estate values held during the Depression and other downturns in history. It was not common to see real estate deflate in value. That being said, I don’t know the volume of transactions. In reality, America needs more homes, especially in growing areas and areas that need replacement housing.